Sununu to CNN’s Soledad O’Brien: Just "Put an Obama Bumper Sticker on Your Forehead"

Wait, what? Mainstream journalists are biased?

Tuesday’s Starting Point began with a bang (and a whimper, on our end) as host Soledad O’Brien and Romney surrogate John Sununu entered into a heated argument over Medicare.

“I understand that this is a Republican talking point because I’ve heard it repeated over and over again,” said O’Brien after Sununu insisted the Romney and Ryan plans were different. “And these numbers have been debunked, as you know, by the Congressional Budget Office.”

“No they haven’t,” said Sununu.

“Yes, they have,” answered O’Brien.

It got worse, or better, depending on your perspective…

“Soledad, stop this!” said Sununu. “All you’re doing is mimicking the stuff that comes out of the White House and gets repeated on the Democratic blog boards out there….”

“I’m telling you what FactCheck.com tells you,” she insisted. “I’m telling you what the CBO tells you. I’m telling you what CNN’s independent analysis does.”

“Put an Obama bumper sticker on your forehead when you do this,” Sununu shot back.

Beyond fantastic! Watch for yourself…

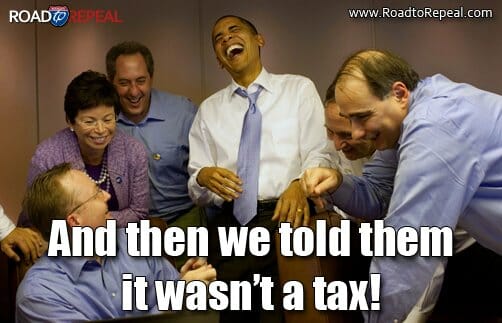

Good News! Obamacare to Slam the Economy with $1 Trillion in New Taxes

Call it a penalty, call it a tax. Call it a “penalty tax” as the Congressional Budget Office (CBO) has.

Call it what you will, we’ll just call it ‘devastating’.

Beltway Confidential reports:

President Obama’s health care law raises taxes by $1 trillion, according to a new report from the Congressional Budget Office.

The individual mandate — which the CBO calls a “penalty tax,” in apparent deference to Chief Justice John Roberts — will produce $55 billion in “penalty payments by uninsured individuals,” the CBO told House Speaker John Boehner, R-Ohio, in a Tuesday letter. Of course, the framers of the law didn’t design the mandate as a tax, and so it produces less revenue than any other provision in the bill.

The “additional hospital insurance tax” is the largest tax increase in Obamacare, projected to bring in $318 billion in new revenues. According to the 2010 report from the Journal of Accountancy, this tax hits “high-income tax payers” — individuals making over $125,000 a year or households making over $250,000 a year.

It may hit so-called high-income tax payers, but it will most certainly have an effect on lower-income families as well.

This from the Tax Policy Blog:

Though Obama vowed not to raise taxes on low-to-middle income Americans, various provisions will most certainly fall on lower income groups. For example, new annual taxes on health insurance providers, drug manufacturers, and the medical device industry will be passed on to all consumers in the form of higher prices and premiums. More direct are new taxes on high-cost “Cadillac” health plans, the tax on tanning services that is already in effect, and the individual mandate tax/penalty.

Regarding the tax/penalty for not purchasing health insurance, my analysis indicates that many low and middle-income households will experience tax increases of substantial magnitude. For example, starting in 2016, an uninsured family of four with income of $50,000 will owe $2,085—or 4.17 percent of income. As shown in the table above, the individual mandate represents a $55 billion tax increase over 10 years, and this is before it is fully phased in.

With high- and low-income earners alike having to worry about massive tax increases, the Obamatax should do wonders for the economy, particularly in the areas of spending and consumer confidence.

Here is a video reminder of Obama saying, “You don’t raise taxes in a recession”.

Number of People on Food Stamps Explodes

Alternate headline: Congressional Budget Office Gets All Racist on President Obama.

‘Cause, you know, it’s racist to call him the Food Stamp President…

Via the Wall Street Journal:

The Congressional Budget Office said Thursday that 45 million people in 2011 received Supplemental Nutrition Assistance Program benefits, a 70% increase from 2007. It said the number of people receiving the benefits, commonly known as food stamps, would continue growing until 2014.Spending for the program, not including administrative costs, rose to $72 billion in 2011, up from $30 billion four years earlier. The CBO projected that one in seven U.S. residents received food stamps last year.In a report, the CBO said roughly two-thirds of jump in spending was tied to an increase in the number of people participating in the program, which provides access to food for the poor, elderly, and disabled. It said another 20% “of the growth in spending can be attributed to temporarily higher benefit amounts enacted in the” 2009 stimulus law.